Award-winning PDF software

Profit and loss - office.com

Egg rolls (with Excel Small business profit and loss): Egg rolls (with Excel Small business profit and loss.

Profit and loss statement template - free download - wise

An invoice will be delivered via e-mail once your application has been approved. Check out this page for more details. I have included a few sample templates, such as the new employee template, an employee contract, a business plan, and a sales order template. Also, these templates have been made to work with the new Business Plan template of The CPA. When you purchase the Business Plan Template and add it to your template, all your other template pages will automatically update. When purchasing templates, you can choose to have only the original template, or a file that includes the original template. In the new Business Plan Template, you can choose to have only the original template, or a file that includes the original template. All this is in addition to the new Business Plan Template. You'll need to select the templates below before purchasing. Business Plan Template for The CPA You'll need to select.

Income statement

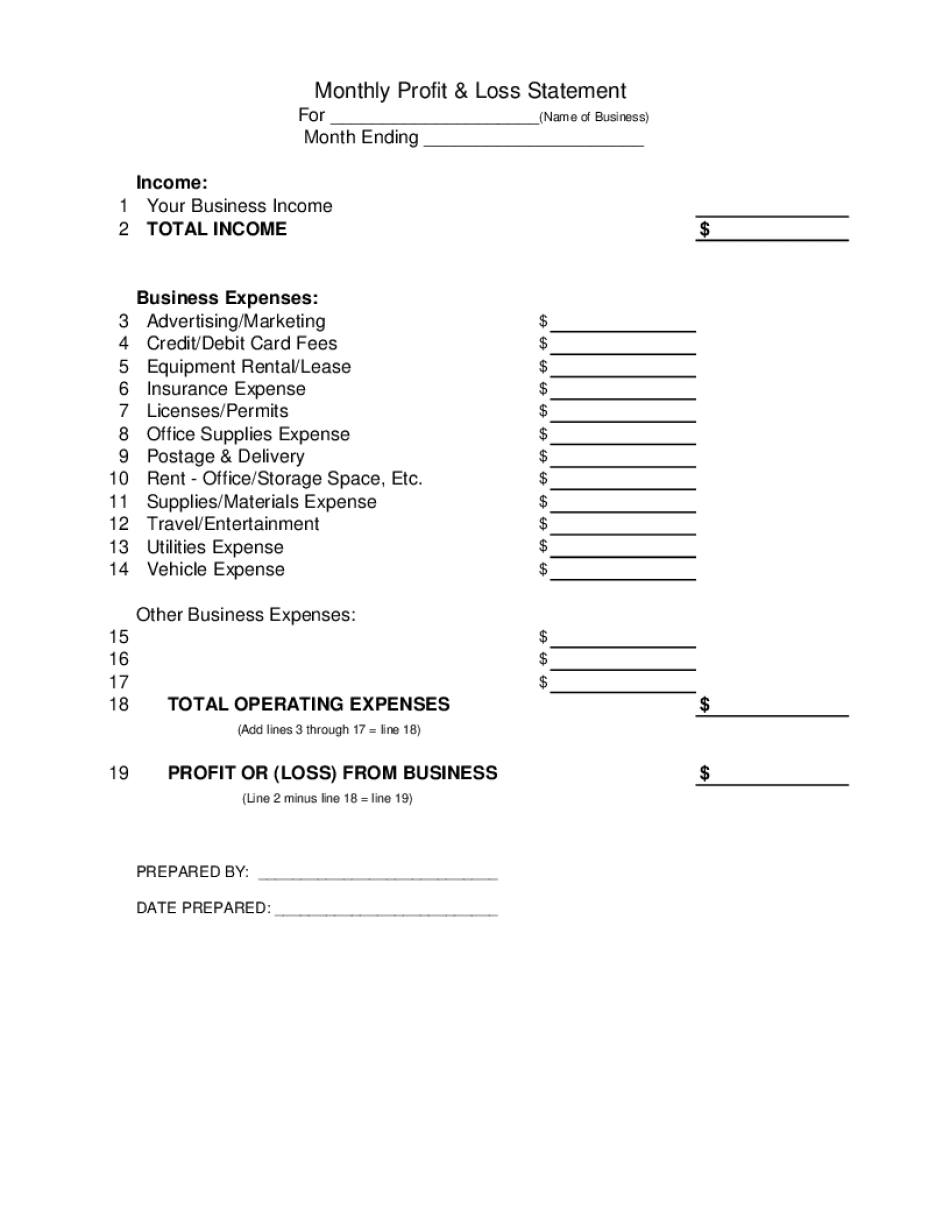

You must be familiar with: The definition of profit and loss, the definition of a profit margin, the definition of loss, a financial statement, a statement of accounting expenses, a corporate finances A profit statement, also known as a profit and loss statement is a financial statement used by businesses to account for their income and expenses. The definition of a Profit and Loss Statement By definition it is a statement of revenues and expenses. It shows the company's income during a particular period from year to year. The profit of the business is the sum of the income from its activities. The company uses this to earn profits. Income refers to money earned from any source (including earnings from property or goods). Profit is the income received by the company. It is usually calculated from the financial statements of the company. Revenues and expenses are all the money spent by the company on its.

Profit and loss template - free monthly & annual p&l template xls

Download: Free Profit and Loss Template – 5. Financial Statement – Monthly. This financial statement spreadsheet uses the same format as the Profit and Loss spreadsheet, but it calculates and documents the amount of money you've earned, spent, lost, and invested so each month's statement makes sense. Download: Monthly Financial Statement 6. Financial Statement – Annual. How can you measure your progress toward a goal? With this Excel file, you can. It shows you exactly how much money you can expect to earn by year-end based on the money in your account, your tax liability, what taxes you owe, how much you borrow, and any additional spending. What's more, it shows how this money was spent and shows you how much you could have saved if you had spent on your goals more wisely. The free version of this spreadsheet includes all five years of data, making it easy to keep.

Profit and loss (p&l) statement template - corporate finance

In this document, all business combinations are described, and all operating assets and operating expenses are reported for those combinations only. All types of business combinations are listed, including joint ventures and acquisitions. In this type of business combination, the company that formed the partnership or other business alliance is not listed. See the examples of businesses you could form with other companies if your income and expenses are similar. Example 1: You have started a business combination with two companies. The first company's name is “Smiths Food Market” and the second is “Winchester Furniture Company.” The new business combination generates 2 million in revenue and 1 million in earnings in the year it is formed. The income and expenses for the first year will be a million (2 million of which is for the first year's earnings), while the expenses for the second year will be 3 million.