Welcome to home this tax talk. My name is Lissandra Everett, and I am the home biz Tax lady. I help home business owners win the tax game. Home biz tax talk airs Monday through Friday at 9:00 o'clock-ish. When you tune into my show, you're going to hear about topics that are important to the home business community. Today, we're talking about profit and loss statements. In a previous broadcast, I talked about a five-point midpoint review. This review is done at the end of the second quarter, but it should ideally be done quarterly or at least twice a year. This review allows you to look back over your finances and assess the financial health of your business. One of the important aspects that I mentioned in the previous broadcast is whether you are operating in profit. This is where a profit and loss statement becomes crucial. In today's talk, I will explain what a profit and loss statement is and why it is important in your business. In the online marketing and home business industry, this topic is not discussed enough. However, if you want your business to truly support your livelihood, paying for your mortgage, utilities, and other expenses, you need to understand the terms of profit and loss, cash flow, and more. This understanding will guide you in making decisions about your business and help you pay your bills. Let's take an example. Suppose someone had a ten thousand dollar month in revenue. It may seem impressive, but it is only half of the story. The question to ask is, how much did they spend to make that ten thousand dollars? If they spent nine thousand dollars, their profit is only a thousand dollars. On the other hand, if they spent twelve thousand dollars, they are operating at a...

Award-winning PDF software

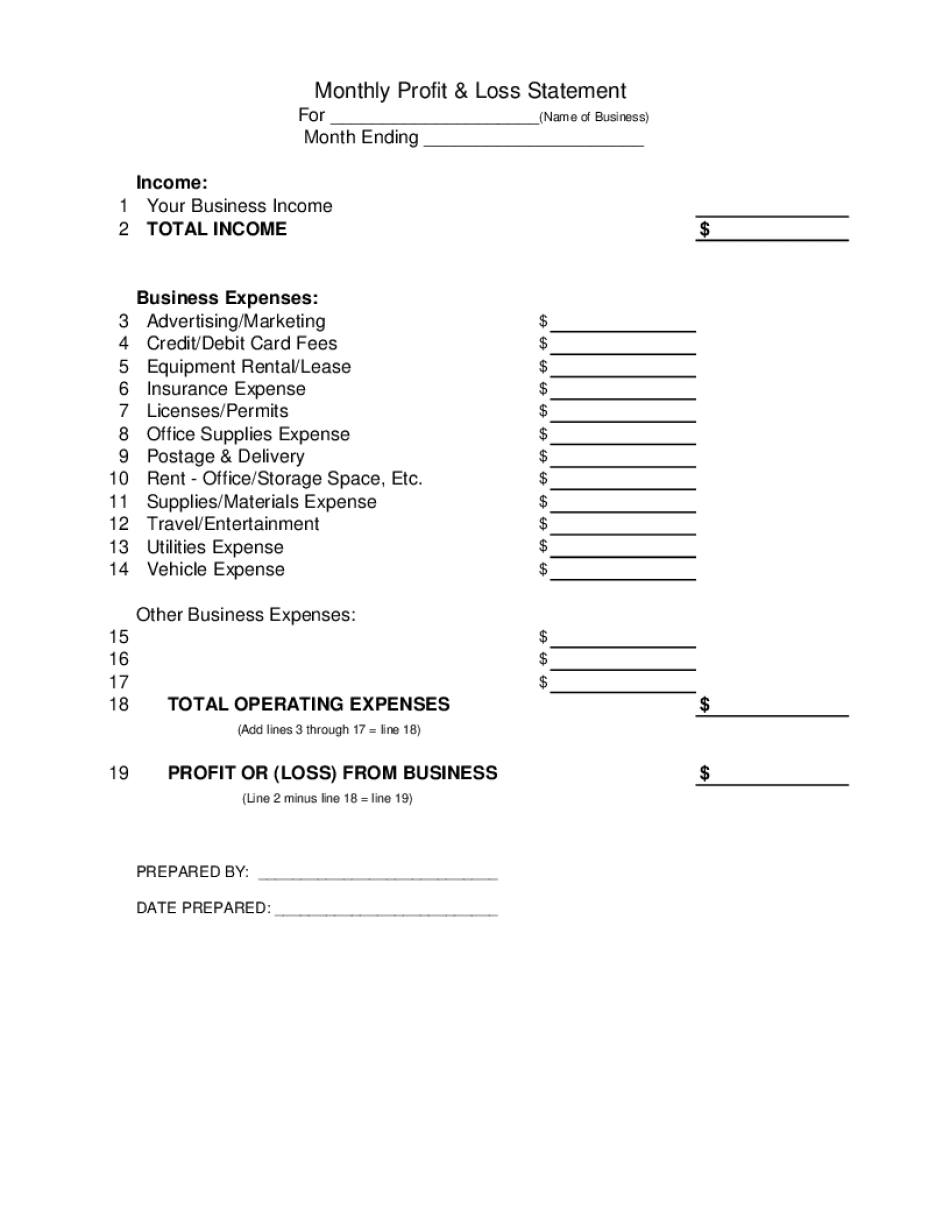

Profit And Loss Statement for self employed Form: What You Should Know

What is profit and loss? Profit and loss is the difference between your revenue and expenses. If your net revenue is 20 and your expenses are 100, then your profit for the year would be 20 – 100 = 10. When would you enter your income and expenses for your tax return? Typically, you make one line on the tax return for each month the business is open. If you get an overpayment, what is the amount of income tax, and when will the tax be due? If your income tax exceeds your deductions, you pay the balance to us. The first 7,500 of overpayment is taxed at the higher rate, up to 10,250, then the tax is tax-free if you have an adjusted gross income of 75,000 or less, or 150,000 for couples filing jointly. If your income exceeds 75,000 or more or your combined income and expenses exceed 150,000, then taxes will likely be due during the following year, however a 965 filing fee is waived for most taxpayers on a standard income tax return. Profit and loss is one of eight sections for your tax return. Here are four of the sections you have access to in the Tax Cuts and Jobs Act. (The other six sections are on page 3). Where can I find my Profit and Loss Statement? To get your Form W-2, you'll need to get the IRS form called Electronic Data Gathering, Analysis, and Retrieval System — commonly known as E-FILE. What does the E-FILE look like? On the Form W-2, you'll need to enter the following information: your name, address, Social Security number, and any tax identification number (TIN) associated with your taxpayer identification number (TIN), the business name for the business with which you work, your annual receipts and payee information, and how much income tax is due. If you choose not to send your annual pay stub as an attachment or if you send your tax return early, you need to enter at least two supporting documents for each source of income, including your pay stub. Profit and Loss Statement for Self Employed (Form W-2) This template is intended to cover the majority of workers in the United States. It includes both an online Profit and Loss Statement template and a downloadable PDF copy that you can customize.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Profit And Loss Template, steer clear of blunders along with furnish it in a timely manner:

How to complete any Profit And Loss Template online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Profit And Loss Template by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Profit And Loss Template from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Profit And Loss Statement for self employed