I figured now is a good time as any to learn about probably what most people focus the most on when they analyze companies, and that's the income statement. The income statement is one of the three financial statements that you look at when you look at a company. There's the income statement, the balance sheet, and the cash flow statement. In this video, we're going to see how the income statement relates to the balance sheet. The income statement is literally just saying how much a company might earn in a given period, and it's always related to a period. It could be an annual income statement, for the year 2008, or a quarterly income statement. The general format is pretty consistent, although there is variation depending on what a business does. In this video, we will cover a plain vanilla income statement for a company that just sells a widget. When you sell a widget, you make it and sell it. You give a customer a widget, and they give you some money. This money is considered revenue or sales. In a given period, let's say 2008, we sold three million dollars worth of widgets. Later on, we will talk about different ways to account for revenue and sales. But for now, let's just say that when you give the widget, you have earned the money that they give you, and that's revenue or sales.

Award-winning PDF software

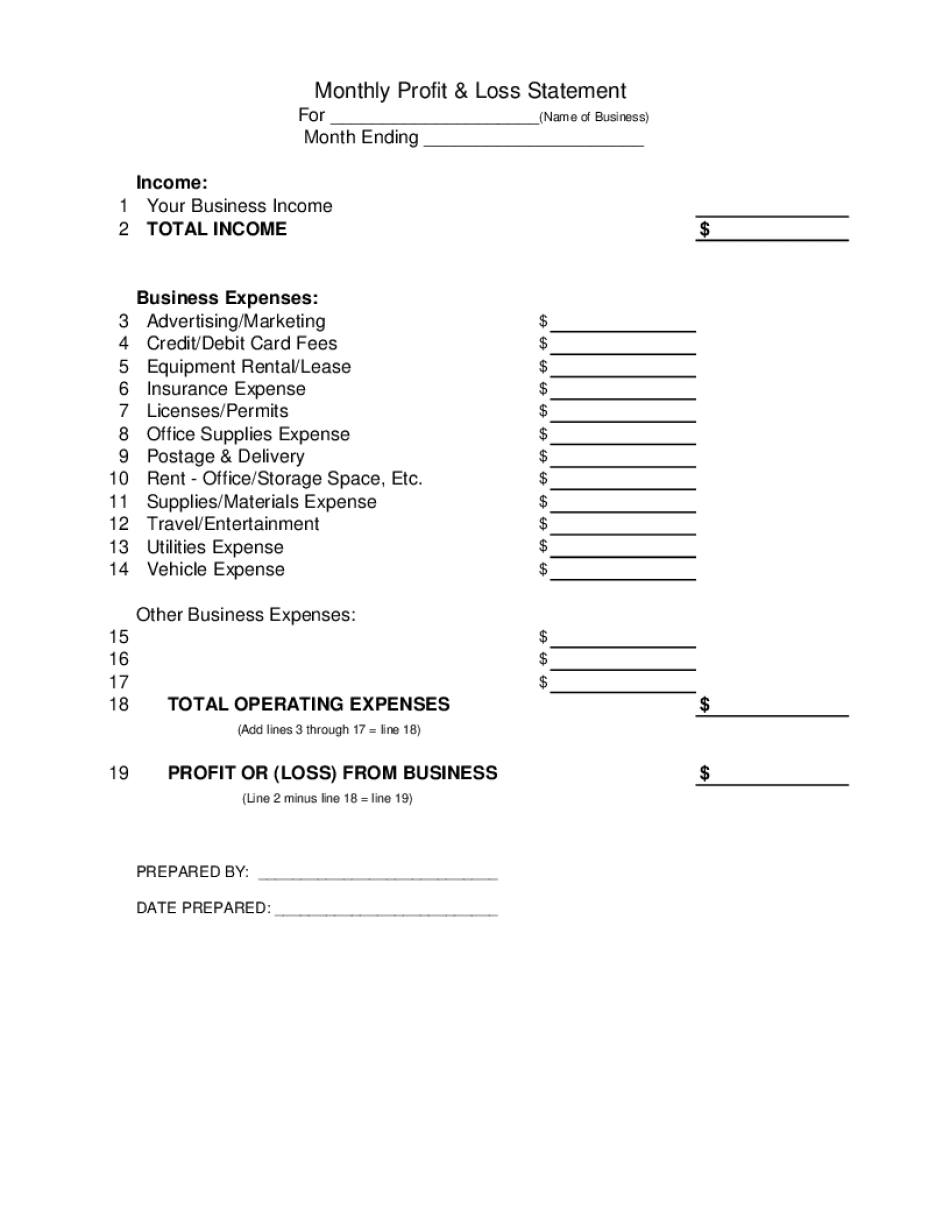

Profit And Loss Statement Pdf Form: What You Should Know

The information is used to estimate the income to be attributed to the business for the year. Each section is given a header, as seen in the Profit and Gain Statement. For a detailed explanation of the 5 main sections, click on the following link, where the Profit & Loss Statement for Self-Employed Borrowers page opens. Profit and Loss Statement | PDF Template — Jot Form This profit and loss statement PDF template lets you have a printable PDF from records coming from the database. This helps save time from doing Profit and Loss Statement Profit and Loss Statement & Summary page P-L-T Form (Professional Liability TIP) P-L-T Form (for Employees) This form allows borrowers to claim a business expense for a person that is employed by them. Borrower Signature and Date The Form has 3 pages: Overview This section should show the general situation as well as the circumstances that apply, as well as how they relate to the business. Borrowers are advised to make any Estimated business expenses. Accounts/Accounting This section should show the business transaction with the person who is on an expenses line. For each expense on each line, the date the expense was created, and the source of the expense. Borrowers will not be able to include a claim of an expense when they are not involved with the transaction and the name associated with the expense line does not contain their name. Borrowers should not include their name if they have never directly controlled or managed the same. Borrowers should not include a business related loan if the account is in financial difficulty. Borrowers cannot use this form to take a loan with their Business Line. They may be able to take a short-term business loan. Other Income This section should be filled in by the person. It should show the source of income from the source that is relevant to the business, the amount of this income, and the location from which the income came. Borrower's name. Date and location of income. This is included in your estimate but not shown on the form. Business Lien Statement/Statement of Liability This form should be filled in by the person. It can be used for a business related personal or bank loan or as an official line of credit.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Profit And Loss Template, steer clear of blunders along with furnish it in a timely manner:

How to complete any Profit And Loss Template online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Profit And Loss Template by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Profit And Loss Template from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Profit And Loss Statement PDF