Hey badass business owners today we're going to talk about the basics of your profit and loss income statement because let's face it it can be very confusing because it looks like just a bunch of numbers on a page but i want to let you know that you need to know your business numbers and your profit and loss is your business's report card so it's really important you understand it because at the end of the day it is the piece of the puzzle that helps you unlock your profits so with that let's take a look now there's going to be a couple different versions of a p l that are out there don't get hung up on the way that yours happens to look they all have the exact same five key sections and that's what we're going to take a look at so you know what those five sections are the first section is the income line and the income section is going to be called either income sales or revenue basically it's all the money that is coming in to the business so if you're receiving money in any way shape or form it's going to be right here under the income section once again it'll say sales revenue everyone is a little bit different but most of the time it's going to be called income the second section that you need to worry about is your cost of goods this is one of the big ones and this is probably where most people make their mistakes and on other videos i dive into this section in detail to show you where those mistakes happen but we'll take a look here real quickly cost of goods is sometimes called cog so when you hear...

PDF editing your way

Complete or edit your profit and loss statement template anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export profit and loss statement directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your profit and loss template as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your profit and loss statement pdf by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Profit And Loss Template

About Profit And Loss Template

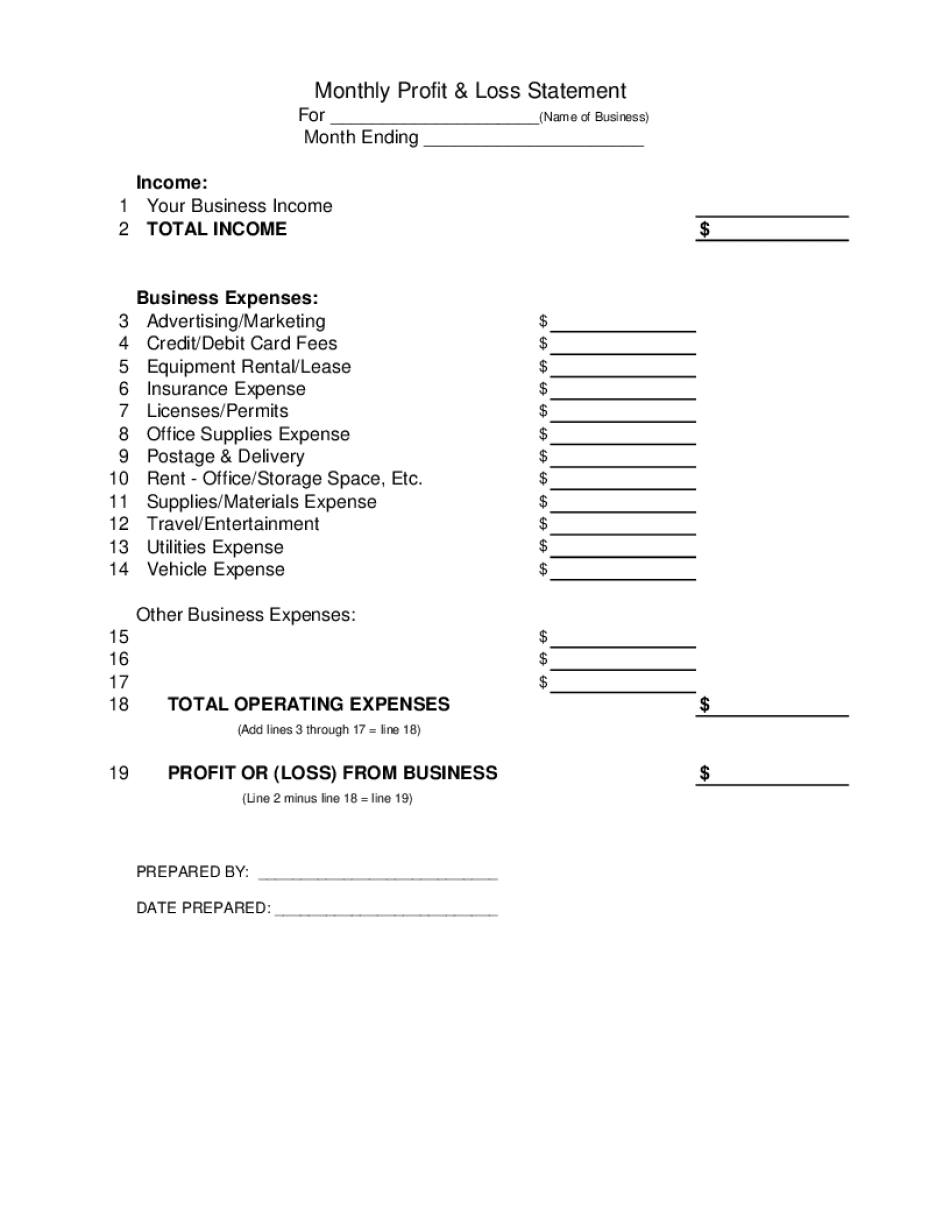

A Profit and Loss Template is a financial tool that helps businesses or individual entrepreneurs track their revenues and expenses over a specific period, typically one year or one quarter. It is also known as an income statement or statement of earnings. The template provides a structured format to record and calculate the net profit or loss generated by a business. The essential components of a Profit and Loss Template include: 1. Revenue: This section includes all the income generated by the business, such as sales revenue, service fees, or any other sources of revenue. 2. Cost of Goods Sold (COGS): This section includes the direct costs incurred to produce or deliver goods or services, such as raw materials, labor, or manufacturing expenses. 3. Gross Profit: It is calculated by subtracting the COGS from the revenue and represents the profitability before considering operating expenses. 4. Operating Expenses: These include various overhead costs required to run the business, such as rent, utilities, salaries, marketing expenses, and other administrative costs. 5. Operating Income: It is derived by subtracting the operating expenses from the gross profit and reflects the profitability of core business operations. 6. Other Income/Expenses: This section captures any miscellaneous income or expenses that are not directly related to the main business operations. 7. Net Profit or Loss: It is calculated by subtracting the total expenses (including operating and other expenses) from the total revenue and represents the overall profitability of the business. A Profit and Loss Template is crucial for businesses of all sizes and industries as it provides a snapshot of their financial performance over a specific period. It helps business owners or financial managers to: 1. Monitor Profitability: It allows businesses to track their revenues, expenses, and ultimately determine their net profit or loss. This insight enables them to assess the financial health of the business and make informed decisions to improve profitability. 2. Financial Planning: By analyzing the Profit and Loss Template, businesses can identify areas where they can reduce costs or increase revenue. This helps in developing realistic financial forecasts and setting future goals for growth. 3. Decision-Making: Businesses can make strategic decisions based on the insights gained from the Profit and Loss Template. It aids in evaluating the effectiveness of marketing campaigns, assessing the profitability of product lines or services, and identifying opportunities to improve operational efficiency. 4. Reporting and Compliance: Profit and Loss Templates are essential for tax reporting purposes, financial audits, or when seeking external financing. It ensures businesses have accurate financial records and are compliant with accounting regulations. In conclusion, a Profit and Loss Template is a valuable tool for businesses as it provides a clear overview of their financial performance and helps in making informed decisions for profitability and growth.

Online solutions assist you to organize your file administration and enhance the productivity of your workflow. Follow the brief manual so that you can complete Profit And Loss Template, keep away from errors and furnish it in a timely way:

How to complete a Profit And Loss Template online:

-

On the website hosting the form, choose Start Now and move to the editor.

-

Use the clues to complete the relevant fields.

-

Include your individual data and contact data.

-

Make sure that you choose to enter correct information and numbers in appropriate fields.

-

Carefully review the written content of the form so as grammar and spelling.

-

Refer to Help section if you have any questions or address our Support staff.

-

Put an digital signature on the Profit And Loss Template printable while using the support of Sign Tool.

-

Once the form is done, click Done.

-

Distribute the ready form by using electronic mail or fax, print it out or download on your device.

PDF editor enables you to make improvements to the Profit And Loss Template Fill Online from any internet linked gadget, customize it based on your needs, sign it electronically and distribute in different approaches.

What people say about us

Gain access to advanced filing opportunities

Video instructions and help with filling out and completing Profit And Loss Template